CPA Pilot

Updated: July 3 2024CPA Pilot is an AI tax assistant designed for tax accountants to automate tax research, client communication, and content creation, enhancing productivity, increasing ...

Tags:Tax Assistant Accountant Tool AI Tax Assistant Tax AutomationCPA Pilot Product Information

What is CPA Pilot?

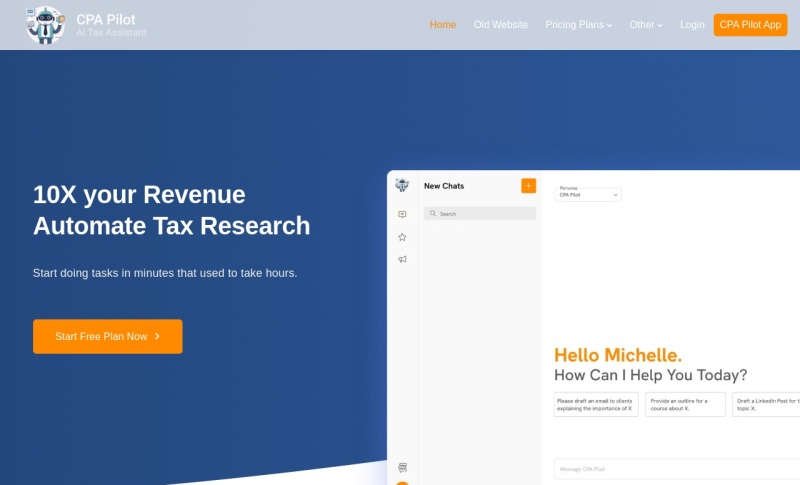

CPA Pilot is an AI tax assistant designed for tax accountants to automate detailed tax research, client emails, and social media content creation, helping professionals enhance productivity, increase revenue, and provide superior client service.

Application Scenarios

- Tax Research: Quickly find and analyze complex tax regulations and policies.

- Client Communication: Automatically generate professional and comprehensible client emails, improving client satisfaction.

- Content Creation: Easily generate tax-related social media content and newsletters, saving time.

Main Features

- Multi-Format File Processing: Supports parsing and understanding IRS forms and publications.

- Accurate Answers: Provides detailed and precise tax answers based on authoritative sources.

- Automated Content Creation: Easily create newsletters and social media posts tailored for tax professionals.

Target Users

CPA Pilot is ideal for CPAs, EAs, and other tax professionals needing an efficient tool to handle complex tax issues, boost productivity, and enhance client satisfaction.

How to Use CPA Pilot?

Visit the CPA Pilot website to choose a suitable subscription plan and start automating tax research and client communication.

Free Trial and Pricing

- CPA Pilot Lite: Free demo version with limited features and resources.

- CPA Pilot: $8.99/month, utilizes GPT-4 AI for smarter and more practical features.

- CPA Pilot Pro: $49.99/month, includes federal and state tax codes, offering a comprehensive tax solution.

- CPA Pilot Client Helper: $59.99/month, integrates CPA Pilot into your website to reduce client interaction time.

Performance Review

Trusted by over 1,000 accountants, CPA Pilot significantly saves time, provides accurate tax answers, and improves client satisfaction.

Alternatives

- TaxJar: Automates sales tax calculation and filing.

- Avalara: Comprehensive tax compliance automation platform.

- TurboTax: Tax filing solutions for individuals and small businesses.

FAQ

- Why choose CPA Pilot over ChatGPT?

CPA Pilot updates more frequently, with 95% accuracy, and uses authoritative data sources. - Does CPA Pilot include all state tax codes?

Currently includes codes for 45 states, with the remaining 5 states being added.

TOP123 Review:

CPA Pilot is an efficient AI tax assistant designed for tax professionals, significantly saving time, boosting productivity, and offering precise tax answers and client communication solutions.